Kelas SEO Pemula Rekomendasi 2026: Cara Cepat Kuasai Ranking Google dari Nol

Di era digital 2026, kemampuan optimasi mesin pencari bukan lagi sekadar nilai tambah, melainkan kebutuhan. ...

Di era digital 2026, kemampuan optimasi mesin pencari bukan lagi sekadar nilai tambah, melainkan kebutuhan. ...

UMKM merupakan fondasi utama perekonomian Indonesia. Kontribusinya terhadap PDB nasional sangat signifikan, begitu pula perannya ...

Transformasi digital sering kali lahir dari keberanian mengambil keputusan yang tidak populer. Dalam konteks inilah ...

Perubahan gaya hidup masyarakat menuju transaksi non-tunai semakin terasa di berbagai sektor usaha. Pelanggan kini ...

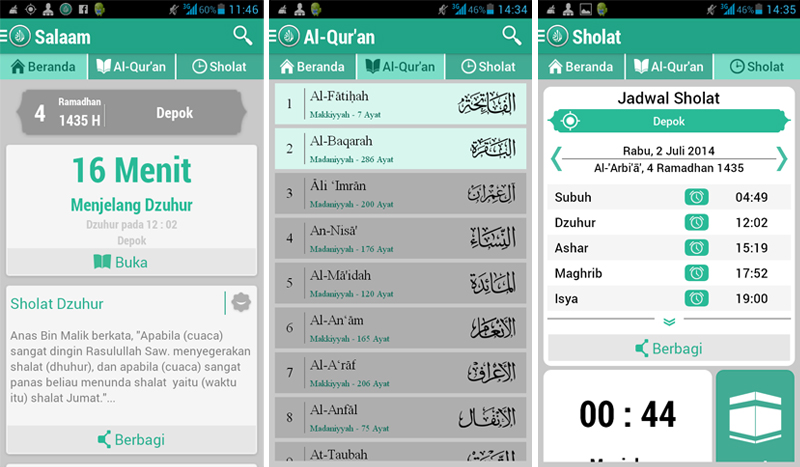

Di era digital saat ini, kebutuhan umat Muslim terhadap aplikasi Islami yang akurat, terpercaya, dan ...

Why do B2B buyers expect the same level of speed as B2C shoppers? Have you ...

Do you want to improve your website’s visibility? If you do not have the time, ...

Setor WA adalah tren baru dalam pengelolaan WhatsApp untuk bisnis dan personal. Pelajari manfaat, cara kerja, serta alasan banyak pelaku usaha mulai menggunakan layanan Setor WA untuk meningkatkan efisiensi dan pelayanan pelanggan.

ROAS 3 bukan standar kejam TikTok, tetapi cermin bahwa banyak brand Indonesia belum efisien dan belum siap bersaing di era impulsif. Pelajari alasan kenapa brand China bisa menang.